Pa State Tax Rate 2025. Pennsylvania released its unemployment insurance tax rate information for 2025 in a contribution rate table issued oct. 3.07% philadelphia city wage tax rates.

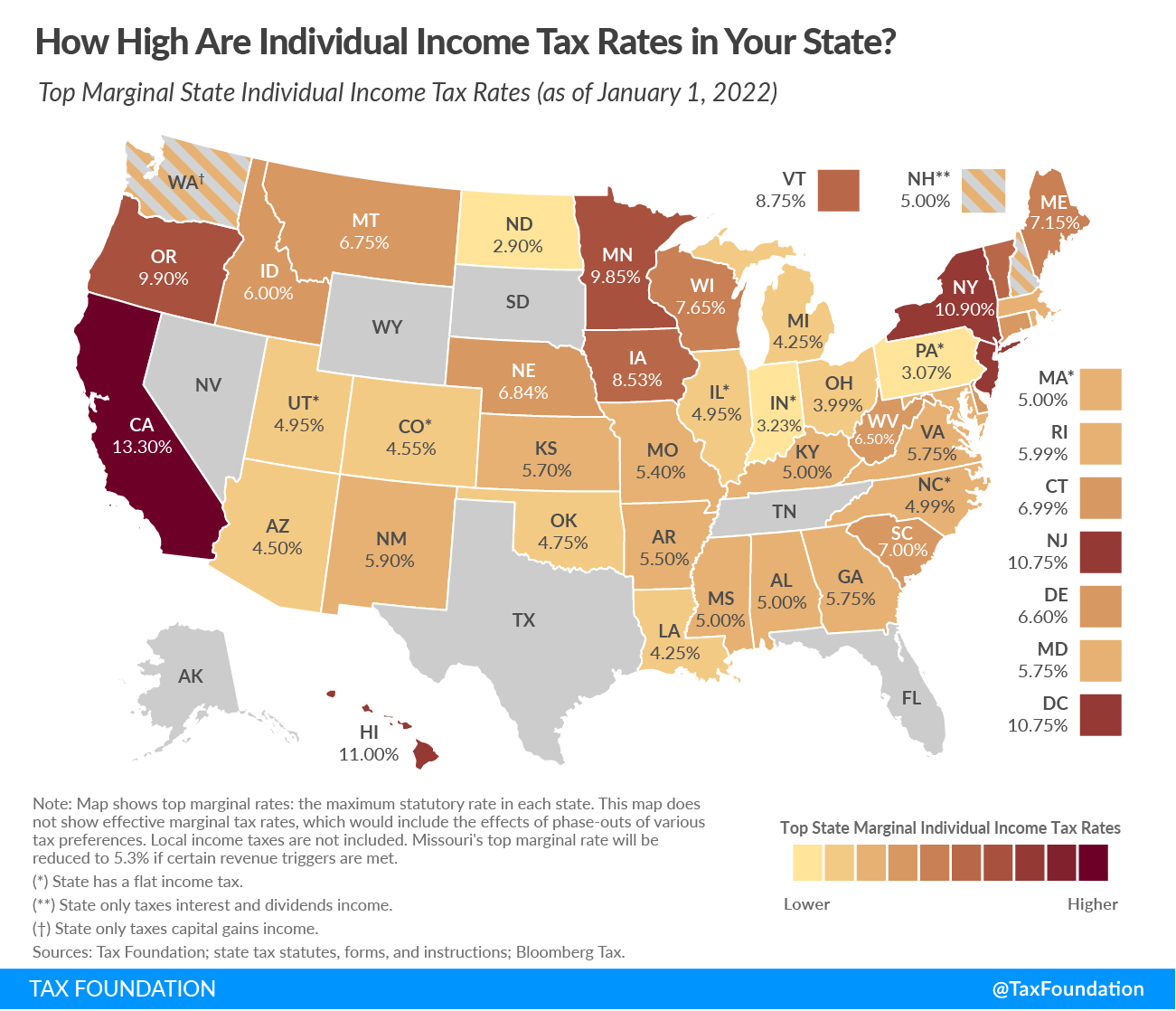

Informing, educating, saving money and time in pennsylvania us tax 2025. Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax.

The Effective Rate Per Hour For 2025 Is $7.25 (Effective 07/24/2009).

The pennsylvania state tax calculator is updated to include:

The Latest Federal Tax Rates For 2025/25 Tax Year As Published By The Irs;

The total tax rates for experienced.

The Withholding Rate For 2025 Remains At 3.07%.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, Pennsylvania released its unemployment insurance tax rate information for 2025 in a contribution rate table issued oct. For married couples who file a joint tax return, the 2025 income brackets and corresponding tax rates are as follows:

Source: www.pennlive.com

Source: www.pennlive.com

Gov. Wolf proposes Pa.’s biggest tax increase ever, but it would be a, 2025 personal income tax forms. The latest federal tax rates for 2025/25 tax year as published by the irs;

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Ranking Of State Tax Rates INCOBEMAN, When income taxes are due varies among the states that collect them. Revenue department releases february 2025 collections.

Source: perlaqsybille.pages.dev

Source: perlaqsybille.pages.dev

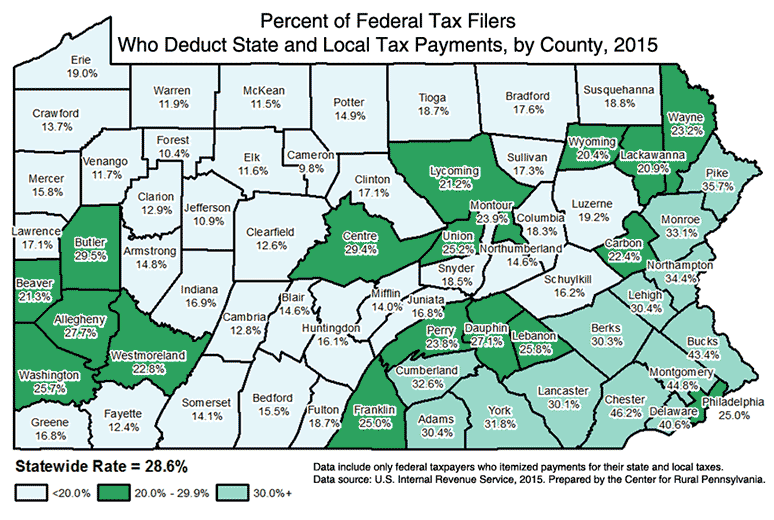

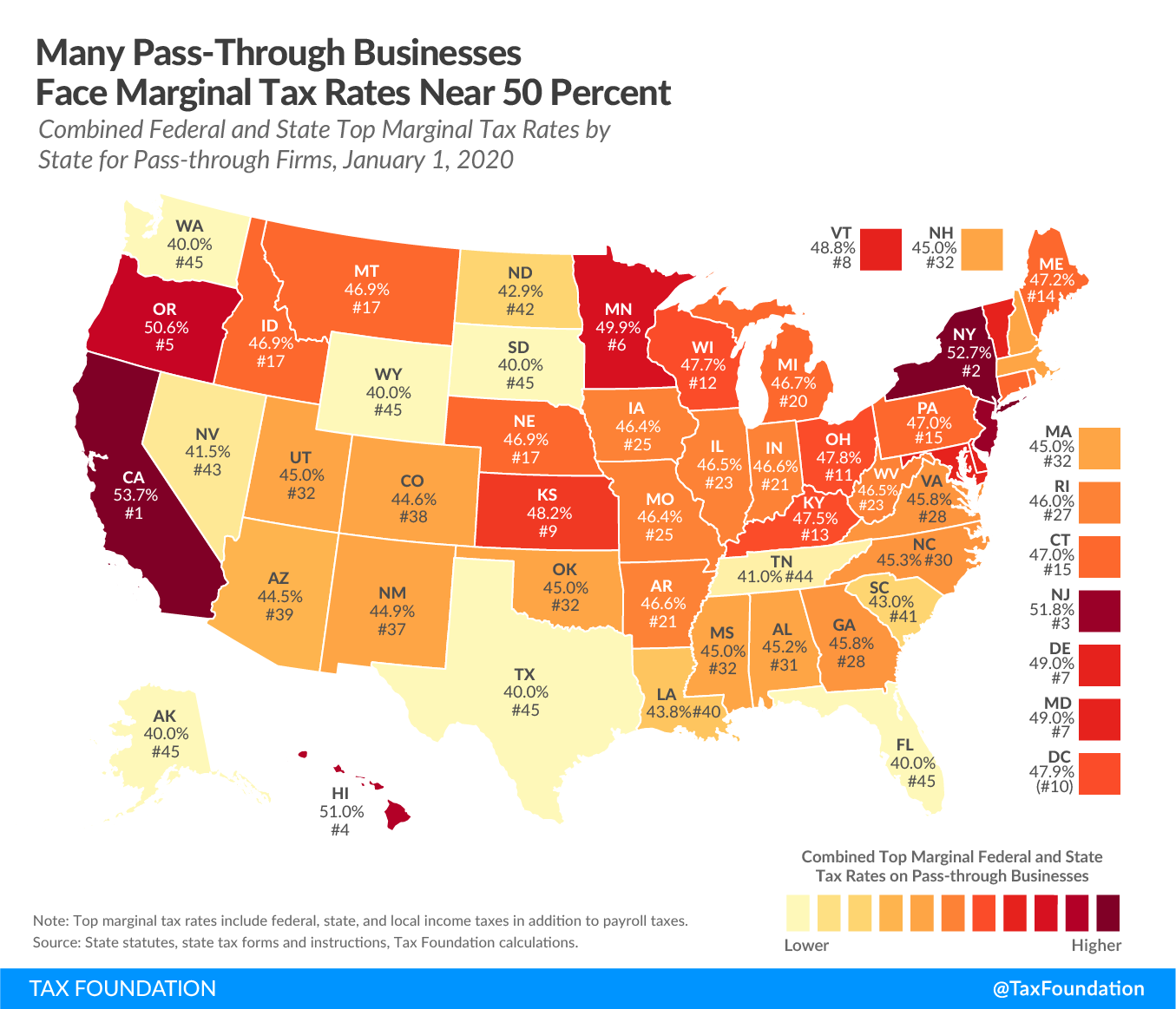

Taxes By State 2025 Dani Michaelina, Pennsylvania has a flat individual income tax rate of 3.07 percent, but some municipalities levy local income taxes. 2025 computed rate range —.014190 to.103734 2025 delinquency computed rate range —.046950 to.136494.

Source: www.pennlive.com

Source: www.pennlive.com

How do Pa's property taxes stack up nationally? This map will tell you, Pennsylvania has a flat income tax rate of 3.07%, the lowest of all the states with a flat tax. The pennsylvania tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in pennsylvania, the calculator allows you to calculate.

Source: www.forbes.com

Source: www.forbes.com

The Best States to Start a Business in 2025 Forbes Advisor, January 1, 2025 through december 31, 2025. The latest state tax rates for 2025/25 tax year.

Source: dorolisawsusie.pages.dev

Source: dorolisawsusie.pages.dev

2025 Tax Brackets Calculator Nedi Lorianne, 90 percent of the tax to be shown on the 2025 personal income tax return; 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or.

Source: www.dochub.com

Source: www.dochub.com

Pa state tax Fill out & sign online DocHub, 2025 personal income tax forms. The statewide sales tax rate is 6%, though two counties charge an additional.

Source: www.rural.pa.gov

Source: www.rural.pa.gov

DataGrams Center for Rural PA, The total tax rates for experienced. 0.90% pennsylvania state tax rate.

Source: upstatetaxp.com

Source: upstatetaxp.com

Marginal Tax Rates for Passthrough Businesses by State Upstate Tax, Harrisburg, pa — pennsylvania collected $2.8 billion in general fund revenue in. The statewide sales tax rate is 6%, though two counties charge an additional.

Pennsylvania Has A Flat Income Tax Rate Of 3.07%, The Lowest Of All The States With A Flat Tax.

Pennsylvania income tax calculator 2025.

January 1, 2025 Through December 31, 2025.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or.